European Real Estate Market – Where To Invest In Property In Europe

Table of Contents

Current Situation in the European Real Estate Market

Where to invest in property in Europe in 2025? Will housing prices drop? The European residential real estate market is undergoing a period of dynamic change and transformation. At Globihome, we analyze the best countries to invest in real estate. According to the latest data from the Mordor Intelligence report, the size of this sector is estimated at an impressive USD 2.04 trillion in 2025, with a projected growth to USD 2.54 trillion by 2030, with a compound annual growth rate (CAGR) of 4.5%.

The real estate market in various European countries differs from each other. In some countries, you can still find cheap properties in Europe. For investors, developers, and potential buyers, understanding current trends and future development directions is key. In this article, you will find Globihome's own analysis and data from international reports by Deloitte, Eurostat, Bankier, and Mordor Intelligence.

Where to invest in property in Europe in 2025?

According to the latest market analysis, Riga (Latvia) leads with remarkable 8.47% rental yields, particularly in the Agenskalns district where returns can reach 11.68%. Madrid continues to attract investors with its blend of cultural heritage and 6.5% yields, especially for studio apartments in the historic Centro district. Warsaw stands out with strong 8% returns and significant annual price growth of 12.1%. Meanwhile, Lisbon attracts global investors through favorable policies and consistent price appreciation, while Bucharest is gaining momentum now that Romania became a full Schengen member on January 1, 2025, enhancing its appeal for cross-border investors.

When selecting your investment location, carefully evaluate market trends, regulatory environments, financing options, and economic stability factors to maximize your returns in the European property market.

Where are property prices rising and falling in Europe?

The European real estate market in 2023-2024 was characterized by significant disparities in price growth. According to the 13th edition of the Deloitte Property Index - Overview of European Residential Markets, some countries experienced spectacular increases, while others noted decreases.

The Deloitte report shows that in 2023, property prices increased in 15 out of 24 surveyed countries, confirming a general upward trend in the European housing market despite economic challenges.

Rise in property prices in Europe:

- Hungary: increase by 13.3%

- Poland: increase by 12.1%

- Portugal: increase by 11.5%

- Czech Republic: increase by 9.3%

Where are property prices falling?

- Italy: decrease by 10.7%

- Israel: decrease by 4.6%

- Denmark: decrease by 3.8%

- Norway: decrease by 3.5%

Looking at the dynamics in local currencies, which give a better picture of actual changes, the highest price increases for new apartments were recorded in Hungary (+10.56%), Norway (+9.05%), and Poland (+7.94%). Conversely, the biggest declines in transaction prices in local currency affected Denmark (-3.61%) and the United Kingdom (-3.29%).

The latest Eurostat data for the third quarter of 2024 confirm further price increases in many EU countries. In Poland, property prices increased by an average of 14.4% year-on-year, the second-highest increase in the EU-27. The only higher increase was recorded in Bulgaria (16.5%). In the same period, the average price increase in the EU-27 countries was 6.5%, and in the eurozone, 4.1%.

Average Property Prices in European Countries

The analysis of average transaction prices for new homes in 2024 shows significant differences between European countries. Below we present a list of prices in EUR per square meter.

Highest Property Prices in Europe:

- Israel: 5439 EUR/m²

- Austria: 4920 EUR/m²

- Germany: 4700 EUR/m²

- France: 4538 EUR/m²

- Netherlands: 4266 EUR/m²

Average Property Prices in Europe:

- Spain: 2745 EUR/m²

- Hungary: 2605 EUR/m²

- Slovenia: 2610 EUR/m²

- Poland: 2219 EUR/m²

- Croatia: 2246 EUR/m²

- Italy: 2118 EUR/m²

Lowest Property Prices in Europe:

- Bosnia and Herzegovina: 1315 EUR/m²

- Greece: 1463 EUR/m²

- Romania: 1504 EUR/m²

The most expensive city in Europe in terms of price per square meter for new apartments is Paris, with an average price of 14,900 EUR/m². Second is Tel Aviv (13,886 EUR/m²), followed by Munich (10,900 EUR/m²).

Housing Availability in European Countries

Despite rising prices in some countries, the purchasing power of residents varies significantly across different European states. The housing affordability index, expressed as the number of average annual gross salaries needed to purchase a 70 m² apartment, shows significant diversity according to a Deloitte report:

- Czech Republic: 13.3 average annual salaries (the hardest accessibility)

- Slovakia: 12.7 average annual salaries

- Israel: 10.2 average annual salaries

- Ireland: 10.2 average annual salaries

- Hungary: 10.2 average annual salaries

- Serbia: 9.8 average annual salaries

- France: 9.8 average annual salaries

- Croatia: 8.3 average annual salaries

- Poland: 7.9 average annual salaries

- Bosnia and Herzegovina: 7.7 average annual salaries

- Netherlands: 7.2 average annual salaries

- United Kingdom: 7.2 average annual salaries

- Slovenia: 6.9 average annual salaries

- Greece: 6.8 average annual salaries

- Romania: 6.8 average annual salaries

- Italy: 5.3 average annual salaries

- Norway: 4.8 average annual salaries (best availability)

- Denmark: 4.7 average annual salaries

In the Czech Republic, an average citizen needs as much as 13.3 average annual gross salaries to buy a standard new 70 m² apartment - the worst result in all of Europe.

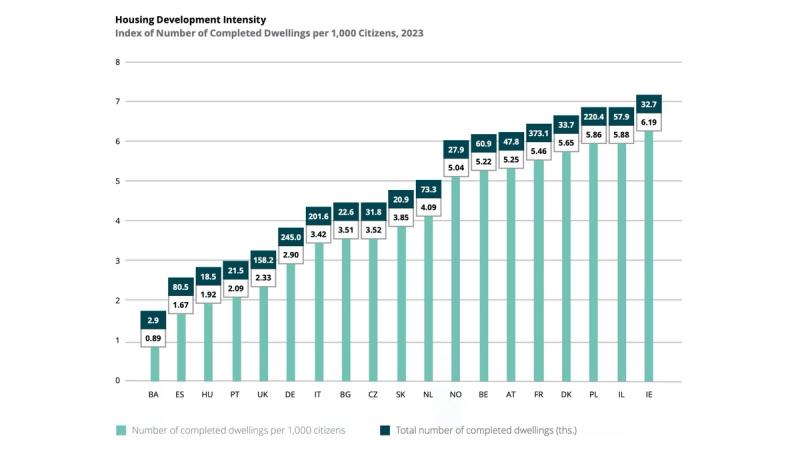

Where are the most new homes being built in Europe?

According to the latest data from the Deloitte report, France, Germany, and Poland are at the forefront of countries with the highest number of newly built homes. In terms of the number of homes completed per 1000 inhabitants, Ireland is the leader in Europe, just ahead of Israel and Poland. These three countries are definitely leading in Europe in terms of the intensity of new housing construction.

How many properties are being built in Europe:

- Ireland: 6.19 units per 1000 inhabitants

- Israel: 5.88 units per 1000 inhabitants

- Poland: 5.86 units per 1000 inhabitants

In terms of the absolute number of homes completed in 2023, the leaders were:

- France: over 373,000 homes

- Germany: 245,000 homes

- Poland: over 220,000 homes

Where are the cheap properties in Europe?

Report of the Polish Economic Institute for Q4 2024 presents the variation in housing prices in major cities of Central and Eastern Europe:

- Prague (Czech Republic): 5.6k EUR/m² - the most expensive city

- Brno (Czech Republic): 4.6k EUR/m²

- Warsaw (Poland): 4.3k EUR/m²

In Q4 2024, the real estate market in Central and Eastern Europe recorded significant increases in housing prices, with Poland and the Czech Republic standing out among other countries. In Gdańsk, housing prices rose by an average of 14% year-on-year, similar to the Czech cities of Pilsen and Brno, where a 13% increase was recorded. Double-digit increases were also observed in Warsaw, Bratislava, Prague, and Liberec. In the same period, Estonia recorded the slowest price growth, oscillating around 1% in both Tallinn and Tartu. The highest real estate prices were observed in the Czech Republic, where the average price per square meter in Prague was 5.6k EUR, exceeding prices in Warsaw (4.3k EUR) and Brno (4.6k EUR). In Bratislava, prices exceeded 4k EUR per square meter, while in other major cities in Central and Eastern Europe, prices ranged from 2.2k to 4k EUR per square meter.

Housing Prices in Spain

Spain is currently one of the most attractive real estate markets in Europe, as evidenced by the latest data on foreign investments in the country.

According to data from Registradores de España, the percentage of real estate purchases in Spain by foreigners was 14.48%. Among the most frequent buyers were: the British (8.57%), Germans (6.67%), Dutch (5.91%), Moroccans (5.30%), French (5.28%), Romanians (5.17%), and Italians (4.76%).

The highest share of transactions concluded by foreigners was recorded in the Balearic Islands (32.8%), Valencia (29.6%), the Canary Islands (24.5%), Murcia (22.8%), Catalonia (16.5%), and Andalusia (14%).

Most Popular Regions in Spain for Real Estate Investment:

According to data for the fourth quarter of 2024, the average price per square meter was 2745 EUR, an increase of 2.4% compared to the previous quarter. Notably, these prices exceeded the levels of 2007, reaching a new historical record, being 12.5% higher than during the peak of the previous real estate boom. This increase was driven by both the used housing market, which saw a 1.6% increase, and new housing, where prices rose by 3.7%. This trend reflects the growing demand for real estate.

Market experts note that following the Russian invasion of Ukraine, Spanish developers observed increased interest in housing among citizens of Poland, Ukraine, and Baltic countries. Many buyers from Central Europe indicate "security motives" as a significant factor in purchasing property in Spain.

Residential Transactions in Europe

The year 2023 saw a decline in the number of residential transactions in most EU countries. According to Eurostat data published in a report, the number of transactions decreased in 13 out of 16 EU countries for which data is available. The biggest drops were recorded in:

- Luxembourg: -43.3%

- Austria: -26.4%

- Hungary: -24.5%

- Finland: -24.5%

Only three countries recorded an increase in the number of transactions:

- Cyprus: +31%

- Poland: +3.9%

- Ireland: +0.6%

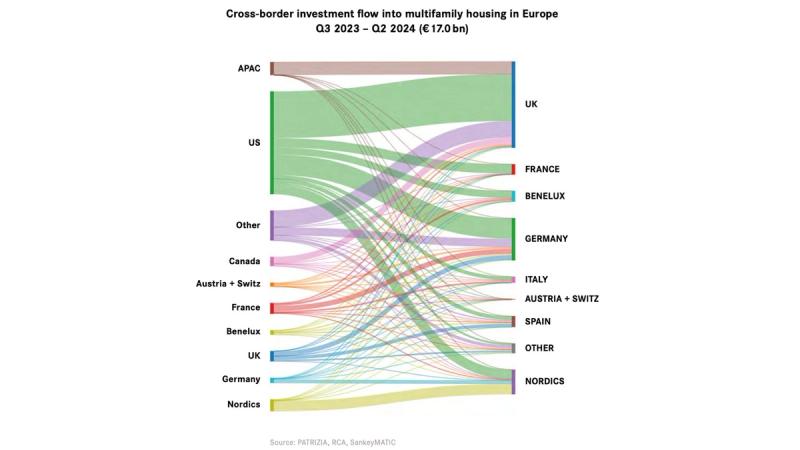

Global residential transactions also saw declines in recent years. In the second quarter of 2024, there were the first signs of stabilization, but with a total amount of 175 billion euros over the last 12 months, the volume remains 33% lower than in the second quarter of 2023.

According to the report "European Residential Markets 2024/2025" published by PATRIZIA, Europe's share is stabilizing at around 22% of the global transaction volume, which is a decrease compared to over 30% in 2020-2021 but a significant improvement compared to the lowest point in 2023.

Property Prices in Europe 2025

According to analysts, 2025 is expected to see a gradual increase in the number of transactions in the European real estate market. Further interest rate cuts should ease pressure on the sector and restore moderate growth.

The international advisory company CBRE forecasts a 15% increase in investment activity in real estate in the UK and other major European markets. The company has identified 2025 as a "breakthrough" year for the real estate sector.

Premium Properties in Europe

The agency Knight Frank in its forecasts for premium properties in 2025 identifies Stockholm, Marbella and Madrid as leaders of growth. The estimated price increase for premium real estate in these locations will exceed 5%.

The Deloitte Property Index 2024 report also presents forecasts regarding changes in the housing markets in Europe. Experts predict that the main areas of change will concern:

- Approach to ESG criteria (31% of respondents)

- Legislation on the rental market (25%)

- Planning regulations (25%)

- Regulations regarding mortgages (19%)

In the German market, a transaction value increase to 40-42 billion euros in 2025 is forecasted, which would mean further growth compared to 35 billion euros in 2024.

Real Estate Agencies in Europe

The European real estate agency market in 2023 was as follows according to Report Linker:

Number of Real Estate Agencies in Europe:

- France: 64,780

- Spain: 47,220

- Italy: 35,390

- Germany: 32,310

The largest year-on-year increase in the number of real estate agencies was recorded in Portugal (5.69%).

Frequently Asked Questions: Where is it best to invest in real estate in Europe?

Summary

Despite a slowdown in some countries, forecasts for 2025 indicate a gradual revival of the market, supported by anticipated interest rate cuts.

For investors and potential buyers, key importance will be the ongoing decisions of central banks regarding interest rates and the general economic situation in individual countries. If you want to know the details of a particular country, check out our recommended articles below.